Monero's Asic Resistant Resilience

May 31, 2024 – by untraceable

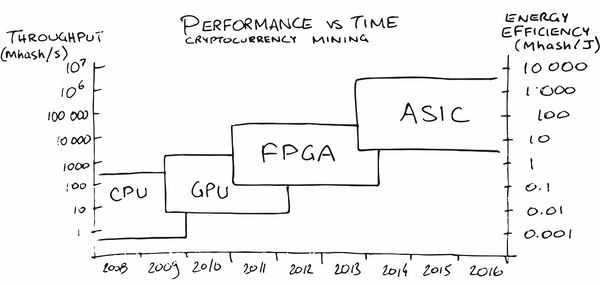

When Bitcoin launched in 2009, anyone could mine it with their home computer. Satoshi originally designed and intended Bitcoin to be mined with CPUs. 1 CPU = 1 Vote. Even so, Satoshi foresaw the competitive nature of miners. Satoshi knew it was only a matter of time before someone found a way to mine Bitcoin using GPUs or even more efficient hardware. Since GPUs can perform more computations per second than a CPU, anyone who kept mining with a CPU would be at a disadvantage.

Today, most Proof of Work (PoW) cryptocurrency networks are mined with Application Specific Integrated Circuits, or ASICs. ASICs are specialized computers that do only one thing, but do it really really well. In the case of Bitcoin ASICs, the one thing they do really well is hash the SHA256 algorithm, which is the algorithm used to mine Bitcoin.

Bitcoin, Bitcoin Cash, Litecoin, Zcash even and DOGE are all mined with ASICs. Monero is the exception. Monero uses an ASIC resistant mining algorithm called RandomX, which was developed specifically for Monero and has been live on the network since the end of 2019.

RandomX is most efficiently mined with CPUs. If you tried to mine Monero with a GPU, you’d be at a disadvantage to CPU miners. If you tried to create an ASIC for RandomX, you would very likely be throwing money away.

We should have a gentleman's agreement to postpone the GPU arms race as long as we can for the good of the network. It's much easer to get new users up to speed if they don't have to worry about GPU drivers and compatibility. It's nice how anyone with just a CPU can compete fairly equally right now."

Satoshi Nakamoto, December 2009

By the summer of 2010, GPU miners were already a prominant force on the Bitcoin network.

By 2011, GPUs were no longer the most efficient way to mine Bitcoin, as miners began to use Field-Programmable Gate Array (FPGA) chips which are even more efficient and powerful than GPUs. But the FGPA reign was shortlived.

In 2012, the first ASIC miners were adapted to mine Bitcoin, and by 2014 the network was dominated by them. When ASICs were inevitably developed for Bitcoin and other cryptocurrencies, they gave-in and embraced them. Monero stood up and said, “No ASICs allowed.” But is that a good thing?

CPU Mining and ASIC Resistance, Pros and Cons

So why is Monero ASIC resistant? Let’s explore the effect of ASIC mining on the Bitcoin network, and see how Monero’s CPU mined network differs.

ASIC’s are expensive, specialized equipment. By “specialized equipment” I mean they only do one thing. You most likely don’t have an ASIC just lying around somewhere in the garage unless you specifically bought one to mine cryptocurrency. The average cost of an ASIC in 2024 is between $3000 to $4000 USD. Besides the ASIC, a miner also has to invest in their mining setup including sound isolation (ASICs are LOUD), and temperature regulation (ASICs put out a lot of hot air!).

As a result, ASIC mining tends to be a centralizing force by raising the barrier to entry. Only those with enough money and resources will enter this highly competitive enterprise. What we observe is that organizations with warehouse-sized operations are the dominant force in the Bitcoin mining scene. These big mining organizations are easily idenfied. In many cases they are KYC’d and subject to local laws and regulations.

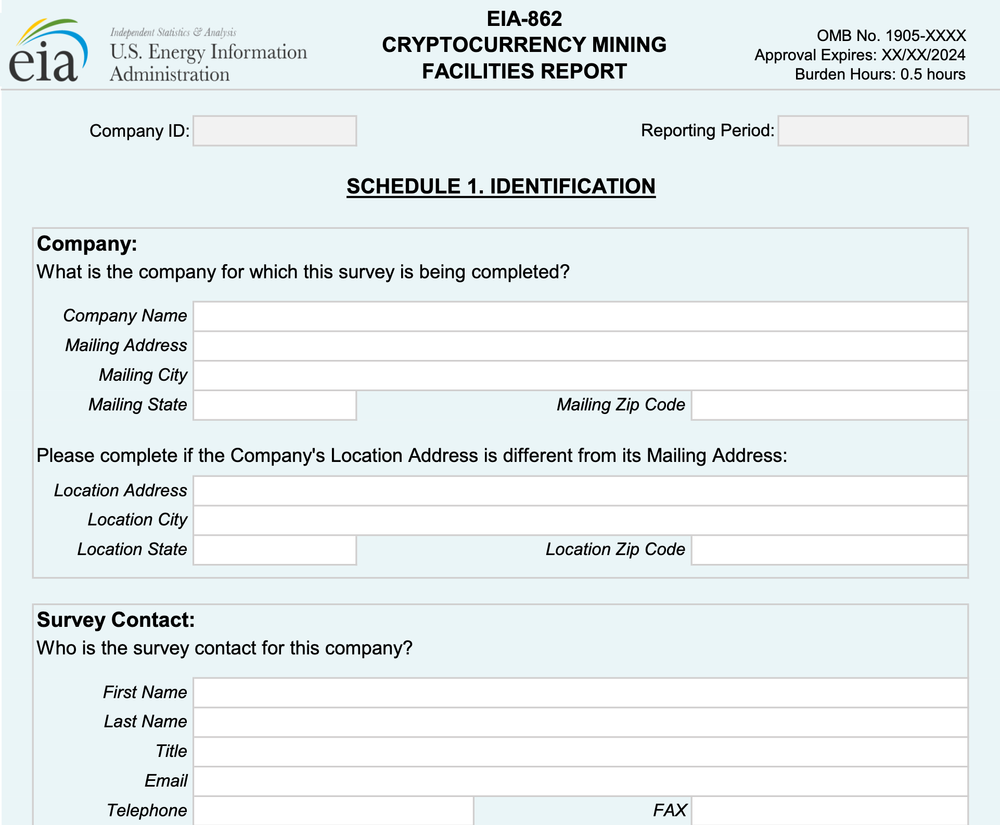

In February 2024, the Biden Administration in the United States announced an emergency data collection initiative targeted at cryptocurrency miners. Under this initiative, the United States Government seeks to create a registry of Bitcoin and Cryptocurrency miners and their geographic locations, with a daily fine of $10,633 for failure to comply. This intrusive data collection could set the stage for future seizure of mining equipment or directives to censor transactions. Failure to comply likely means the failure of your business as a mining operation. Thanks to ASIC resistance, this form of tyranny is mostly unenforceable for Monero miners.

Example form cryptocurrency miners will be required to submit to the US Energy Information Administration.

In contrast to ASIC machines, CPUs are multipurpose commodity hardware. CPUs are widely available worldwide, and you probably have one in your hands or in your pocket right now. Anyone who wishes to mine Monero can do so relatively easily, and with zero startup costs. The barrier to entry is extremely low, allowing almost anyone to participate. Someone mining Monero at home arouses no more attention than someone playing a computer game.

That isn’t to say ASIC resistance is perfect. ASIC mining is vastly more energy efficient than CPU mining. The lower barrier to entry of CPU mining also comes with an unintended consequence. Botnets. Unauthorized computer programs that inject themselves into an unsuspecting victim’s computer to mine Monero in stealth at the benefit of the botnet operators. These botnets can consist of thousands of infected computers around the world. Botnets increase Monero’s total hashrate, but they also make mining less profitable for all other miners. Botnets don’t pay for electricity and there are fewer rewards available for honest miners.

In May 2024, the “largest botnet sting ever” took place which coincided with Monero losing approximately 30% of its hashrate overnight. Botnets also negatively impact Monero’s public image and give the media ammo to levy the ignorant narrative that Monero must be a currency for “criminals”.

ASIC Resistance contributes to Censorship Resistance

Not only are Bitcoin miners and mining pools under a centralizing effect due to ASICs, but the manufacture of the ASIC chips themselves is highly centralized. Some estimates say that Bitmain, a Chinese ASIC manufacturing company, manufactures up to 90% of all Bitcoin ASIC miners in the world. Besides being the largest manufacturer of ASICs, Bitmain has also been known to mine on their own chips first before selling the used machines to the public once the ASICs are less profitable. Bitmain have also been accused of utilizing special firmware that put Bitmain owned ASICs at an advantage over other ASIC owners. See Covert ASICBoost.

Bitcoin’s most critical value proposition is then in jeopardy due to this centralizing effect of ASIC mining and manufacture: censorship resistance. Bitcoin’s regulated, identified, and compliant ASIC miners can be easily cooerced to censor transactions. To not include transactions that lawmakers deem “illegal” into a block. After all, most Bitcoin miners are businesses and must follow local laws and regulations if they intend to remain in business.

As we stand today, Bitcoin is not a censorship resistant network, rather it just happens to be a network that is not currently being censored."

Luke Dashjr, Bitcoin developer and Founder of Ocean mining pool

We have already seen the warning signs when in May, 2021, Marathon mining pool announced they mined the first OFAC Compliant block. Following community outcry, Marathon announced they would stop mining OFAC compliant blocks. But we have already seen it is possible to censor Bitcoin. Meaning Bitcoin is not censorship resistant, but rather it is just not currently under active censorship.

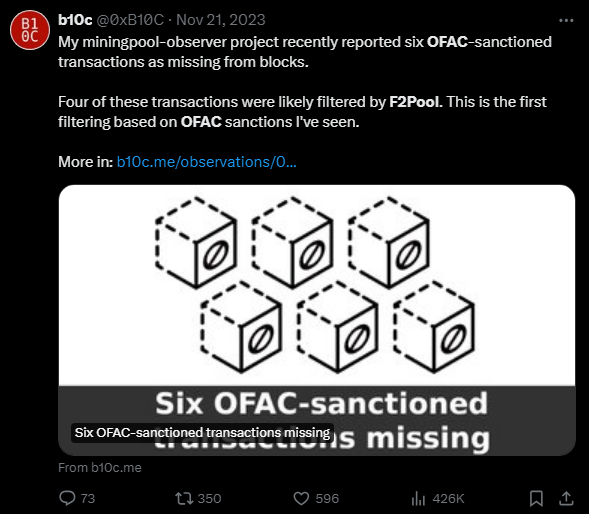

Then later in November 2023 we saw the first ever transactions censored by F2pool mining pool. While the censored transactions did eventually make it into a block when another miner picked them up, that doesn’t make Bitcoin censorship resistant. The path to censorship on Bitcoin is clear. If mining pools are expected to exclude certain transactions in the future, it will become increasingly difficult or impossible for certain people to transact with Bitcoin.

“filtering” transactions is a euphemism for censorship

Monero’s ASIC resistant mining algorithm, RandomX, addresses these issues by lowering the barrier to entry for mining. Since anyone can mine Monero with commodity hardware that they likely already own, everyone is on an even playing field.

There is no monopoly on the manufacture or distribution of CPUs. Large organizations have no advantage over you or anyone else when it comes to mining Monero. Individuals, hobby miners, and small scale mining operations dominate Monero’s hashrate. Monero miners are spread-out globally. They are not easily identifiable or able to be cooerced by unjust laws or regulations. The mining of Monero is done largely by people. Not companies.

But ASIC resistance is only one ingredient to Monero’s censorship resistance. Since Monero transactions are private by default, Monero is fungible. Monero transactions are indistinguishable and cannot be discriminated against. CPU mining further contributes to the Monero network’s resilience by making it difficult to attack or regulate the miners themselves.

Conclusion

Monero’s RandomX mining algorithm is much less energy efficient than ASIC mining, and is subject to botnet mining, but in return, the network is more resilient, censorship resistant, and miners cannot be easily targeted. Monero users believe the pros of ASIC resistance highly outweigh the cons for the purpose of decentralized peer-to-peer digital cash that cannot be censored.

by untraceable – May 31, 2024

Buy untraceable a coffee, send XMR to:

8341oirGEbL9R2G7514b53AktSvokRTf8SQmKC2Y7QWMF1AoCaynTHkXN86Tx5BAfh343Umxng6rYVW22z7cacCdErt1LDc

Resources:

Post on Twitter/X by @GrassFedBitcoin about Bitmain the centralizing nature of ASICs and their manufacture.

Marathon mines first OFAC compliant block.

Netherlands, France, and Germany lead ‘largest ever’ botnet sting

Six OFAC-sanctioned transactions missing

The Biden Administration Wants To Create A Registry Of Bitcoin Miners

This was so excellent and well written. Thank you. I have posted this website article on several of our social media platforms. Most awesome and reinforces our commitment to Monero and decentralization.

That’s very encouraging to hear. Thanks for spreading the word!