How does Monero work?

Monero is a revolutionary system developed in the open by contributors around the world to create a digital cash alternative to the traditional financial system and challenge governments’ monopoly on money control and creation.

Monero is a decentralized network of computers operated by users around the world which requires no permission to use or operate. Monero is a currency, and it is also money which is native to the internet. Monero exists by the foundational principles of the Cypherpunk Manifesto.

In this article, we cover the following:

How Monero’s Privacy Works

How Monero’s Supply Schedule and Tail Emission Work

How Monero’s Dynamic Blocks work

Feel free to skip ahead to any of these sections by clicking the links above.

Alternatively, visit Monero.Garden – a community project where you can learn about Monero.

Key differences that set Monero apart from other “cryptocurrencies”:

Monero was fairly launched, meaning no Monero tokens were pre-mined (created out of thin air at launch). All Monero in existence today were mined by computers expending electricity and computing power (Proof of Work).

There is no leader, no founder, no CEO, and no single person who can dictate the direction of Monero.

Monero is CPU mined, meaning that the barrier for entry is low, allowing anyone to participate in running the network with low or zero start-up costs. Since anyone can participate, this also makes it practically impossible to identify or target all Monero miners or force them to comply with unjust laws.

Monero is completely private. No transaction details are publicly viewable by anyone other than the parties involved in a transaction. Sender, receiver and amounts are hidden by default.

Due to Monero’s strong privacy, Monero is fungible, meaning that all Monero are indistinguishable and cannot be discriminated against based on who owned the Monero before or what it was used for in the past.

Monero offers block rewards to miners in perpetuity (called tail emission) meaning that miners will always have an incentive to secure the chain.

Monero has a low inflation rate which is conducive to a good store of value as well as the ability to accomodate growing economies.

Monero scales on-chain, not through second or third layers which often come with unnacceptable security and custodial trade-offs.

Monero is truly censorship resistant. While many cryptocurrencies claim to be censorship resistant, most are not. Transactions on transparent blockchains can be discriminated against.

How Monero’s Privacy Works

Monero uses a combination of technologies to achieve a censorship resistant, private, secure, and fungible digital cash system. The four main technologies encompassing Monero’s privacy are: Stealth Addresses, Ring Confidential Transactions, Ring Signatures, and Dandelion++.

Ring Signatures

In cryptography, a ring signature is a digital signature technique that can be executed by any member of a designated group, each possessing their own keys. Consequently, a message signed with a ring signature is endorsed by an undisclosed individual within that group.

For example, a ring signature could be employed to provide an anonymous signature from “a high-ranking White House official” without revealing the specific official’s identity.

In Monero, Ring Signatures protect the sender of a transaction. When you send a Monero transaction, your real output’s signature is concealed among other decoy signatures, making it impractical to determine which output was the true spend.

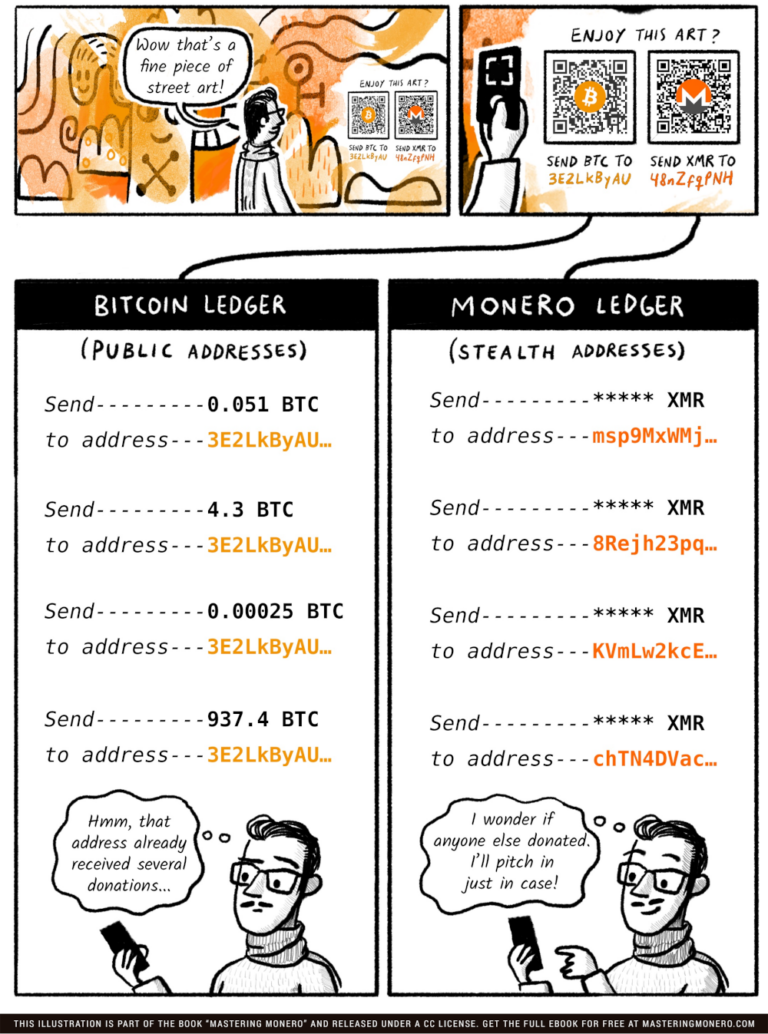

Stealth Addresses

Stealth addresses allow and require the sender to create random one-time addresses for every Monero transaction on behalf of the recipient. The recipient can publish just one address, yet have all of his/her incoming payments go to unique addresses on the blockchain, where they cannot be linked back to either the recipient’s published address or any other transactions’ addresses. By using stealth addresses, only the sender and receiver can determine where a payment was sent.

Ring Confidential Transactions

RingCT or Ring Confidential Transactions are the method by which the amount of Monero sent is concealed. RingCT maintains the confidentiality of sensitive information by enabling the sender to confirm possessing sufficient Monero for a transaction without disclosing the exact amount. This is accomplished through the use of cryptographic commitments and range proofs, ensuring the sender’s transaction details remain concealed.

For a more technical explanation of RingCT, read Oleg Fomenko’s Explanation.

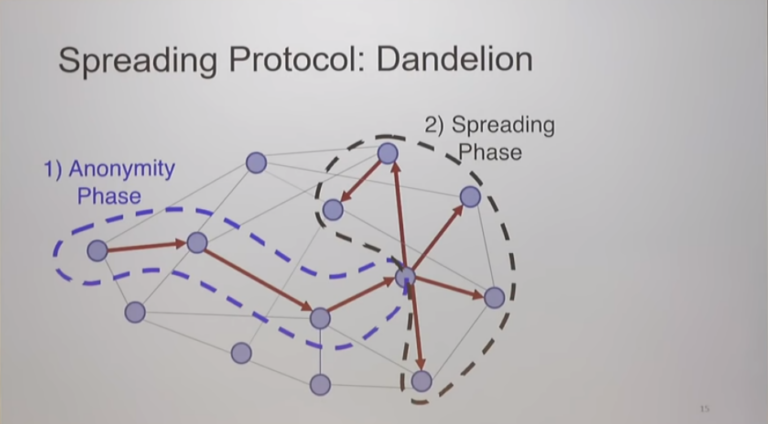

Dandelion++

Dandelion++ is a protocol that prevents linking an IP address to the sender of a transaction. In this protocol, there are two phases, the stem phase (or anonymity phase), and the fluff phase (or spreading phase); both of them together are supposed to represent the form of a dandelion.

The “stem phase” occurs when this random node announces a transaction to a proxy node. The proxy node then announces the transaction to all other nodes, which is the “fluff phase.” Stem phase is also called the “anonymity phase,” while fluff phase is called “spread phase.” The “fluff phase” uses diffusion. It’s a flooding process where communication timing is random. This makes it harder for an attacker to locate the source.

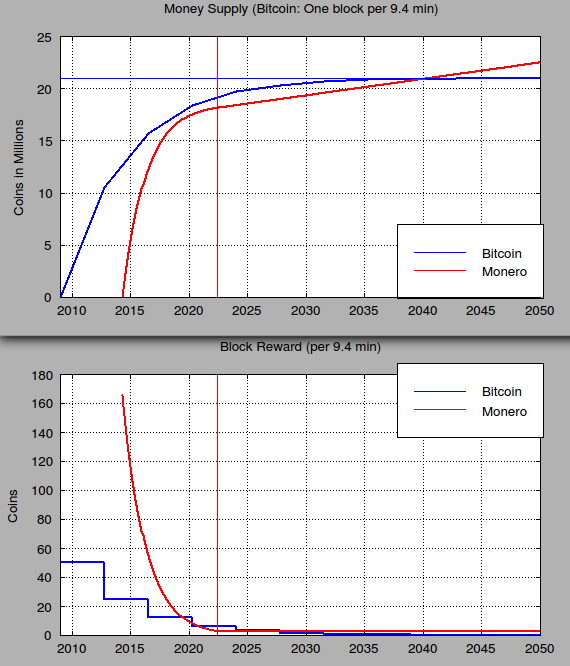

How Monero’s Supply Schedule and Tail Emission work

Monero’s supply schedule differs from most other cryptocurrencies in that from it’s genesis, the creation of new coins was continuously decelerating, meaning that each new block created fewer new coins than the block before. This continuous deceleration of the block reward continued until June 9, 2022 when the block reward became fixed at 0.3 XMR per minute. This is known as the Tail Emission.

For comparison, the Bitcoin supply schedule has a stepwise deceleration known as the “Halving”. The Halving is when the block reward is reduced by 50% every four years until eventually the block reward will reach zero, meaning no new coins will ever be created.

Monero’s tail emission results in a gradually decreasing annual inflation. At the start of the Tail Emission era, Monero’s annual inflation was 0.87%. As of June 2024, two years after Tail Emission began, Monero’s inflation rate was 0.855%. Monero’s supply and inflation rate are also perfectly predictable in the far future. In the year 2050, Monero’s annual inflation rate will be 0.7%, in the year 2100 it will be 0.52%. You can view a chart of Monero’s future inflation rate here. For comparison, Gold’s inflation rate is between 1% to 2% per year.

Since the creation of new Monero coins is fixed and the total supply is uncapped, the new yearly supply as a percentage of the total supply is always decreasing, meaning that Monero’s inflation rate trends towards 0% forever, but never actually reaches 0%. This is known as asymptotic inflation. Monero could also be considered to be disinflationary, as the inflation rate is continuously decreasing.

Other research reveals that “a fixed block reward does not lead to an abundant supply. In fact, due to the inevitability of lost coins, a fixed reward converges to a stable monetary supply that is neither inflationary nor deflationary, with the total supply proportional to rate of tail emission and probability of coin loss.”

Monero’s Tail Emission serves a few purposes; to incentivize miners to continue to secure the network since they will always be rewarded for doing so, to keep transaction fees low, and in order for Monero’s Dynamic Blocks to function.

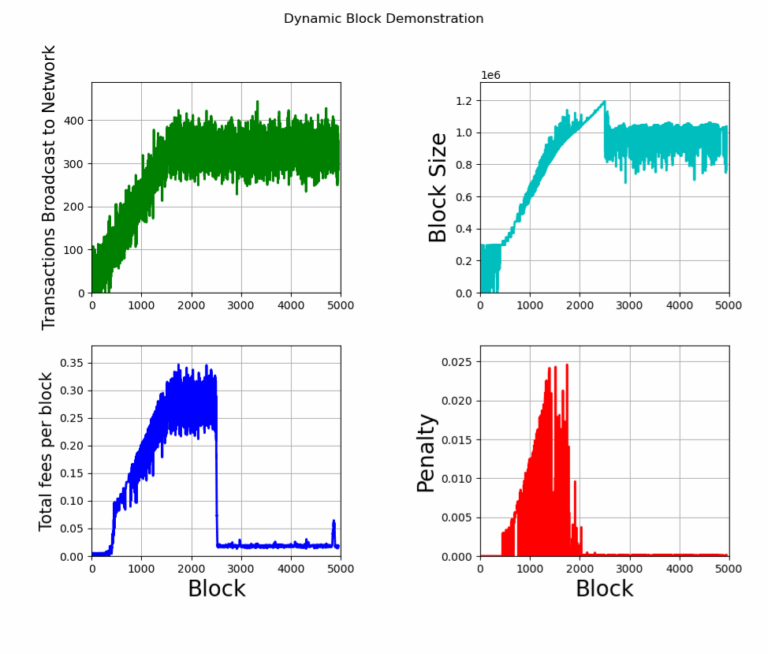

How Monero’s Dynamic Blocks work

Dynamic Blocks is another feature pioneered by Monero developers. Whereas Bitcoin and most other Bitcoin forks have a capped blocksize, Dynamic Blocks expand and contract to accomodate growing demand. This allows the blockchain to process more transactions and ease congestion, while generating more transaction fees for miners. When there are fewer transactions, the blocks shrink once again. The mechanism by which this works is dictated by the median block size.

Users must pay higher fees in order for the block size to increase, and miners must take a block reward penalty in order to mine larger blocks, meaning that there is a cost associated with increasing the block size. This algorithm disincentivizes spamming the network to bloat the blockchain.

That being said, there are still limits in place for how quickly blocks can grow, and those limits cannot be exceeded no matter how much a user pays in transaction fees. The algorithm by which Dynamic Blocks work is complex and beyond the scope of this article, but further reading can be done here.

Dynamic Blocks not only allow the Monero network to quickly clear transaction backlogs, it is also what allows transaction fees to remain low. As you can see per the Dynamic Blocks simulation above, transaction fees increase temporarily in order to accomodate the increase in transaction volume, but once the transaction volume levels off, transaction fees return to baseline and miners no longer need to pay penalties. This is in contrast to networks with capped block sizes such as Bitcoin, in which users must continuously pay higher fees to compete for blockspace. Because Monero has a fixed reward and Tail Emission, miners are not dependant on a fee market, and fees can remain low forever.

While this article covered the basic aspects of what makes Monero tick, we barely scratched the surface and there is still a lot left to learn. Below you will find additional resources for understanding the inner workings of Monero and it’s design decisions.

How the hell does Monero work? (video)

The basic economics of Monero (video)

Monero Means Money – presentation by Dr. Daniel Kim (video)

Monero’s dynamic blocks (video)

Monero Scaling Documents by Articmine – Dynamic Block Size and Fee Algorithm

Go to the Educational section for more resources➣

Illustrations on this page by anhdres.